Invest In Your HVAC System

Keep Students Healthy at School with Cleaner Air

-

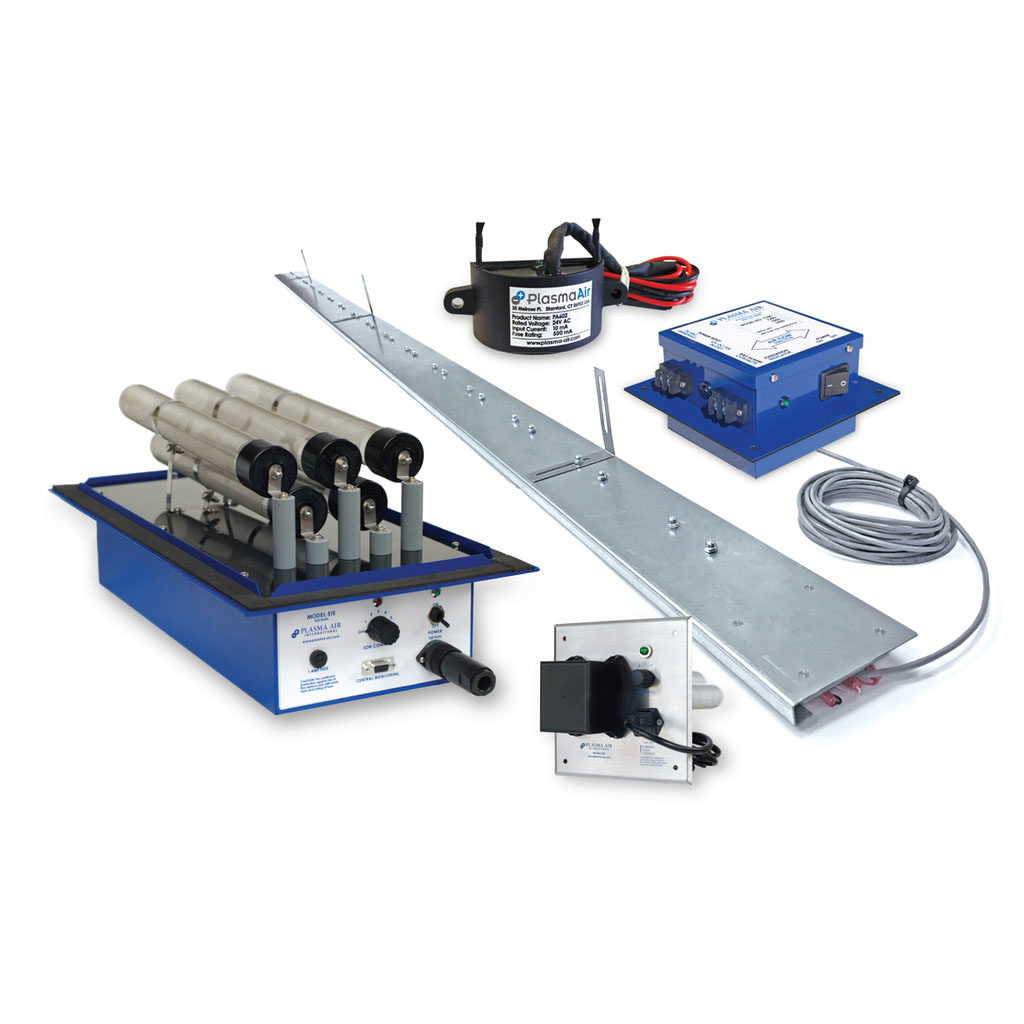

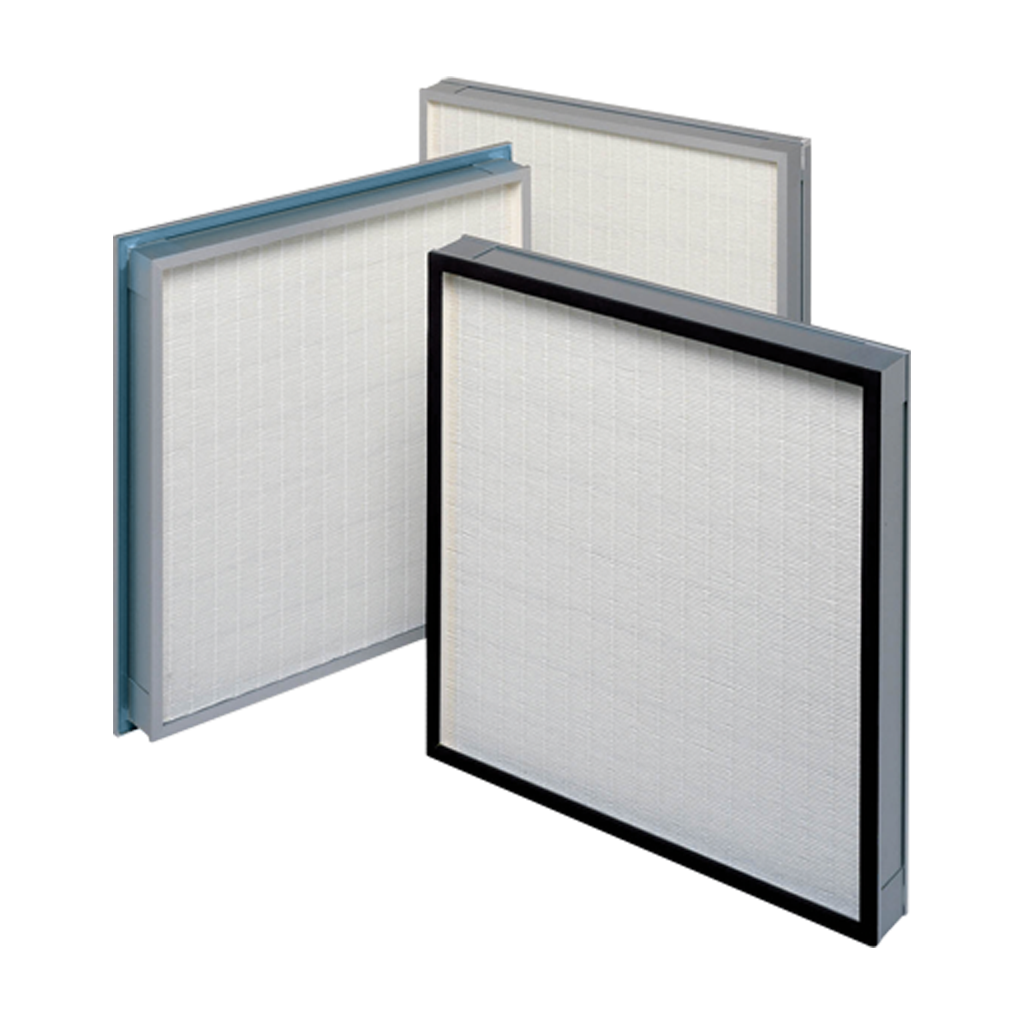

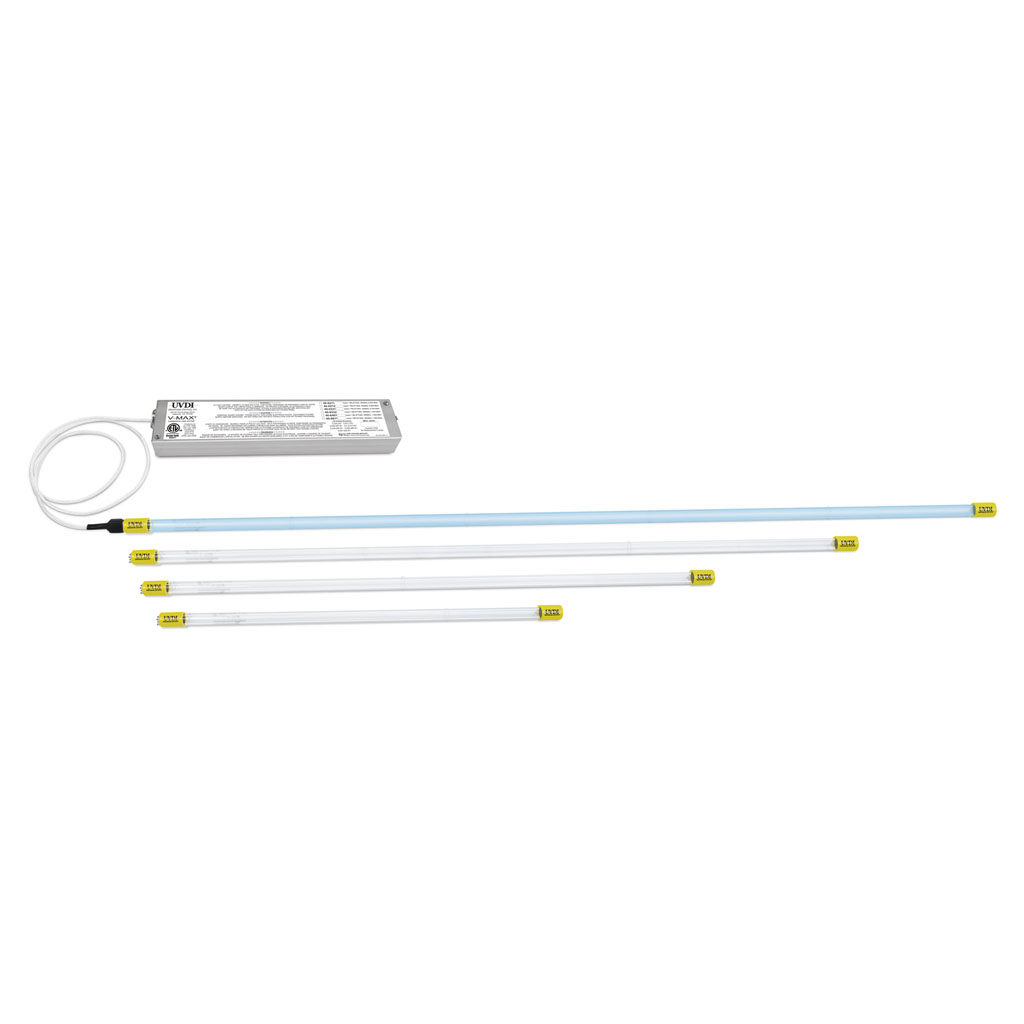

Pathogen-Fighting Filtration

-

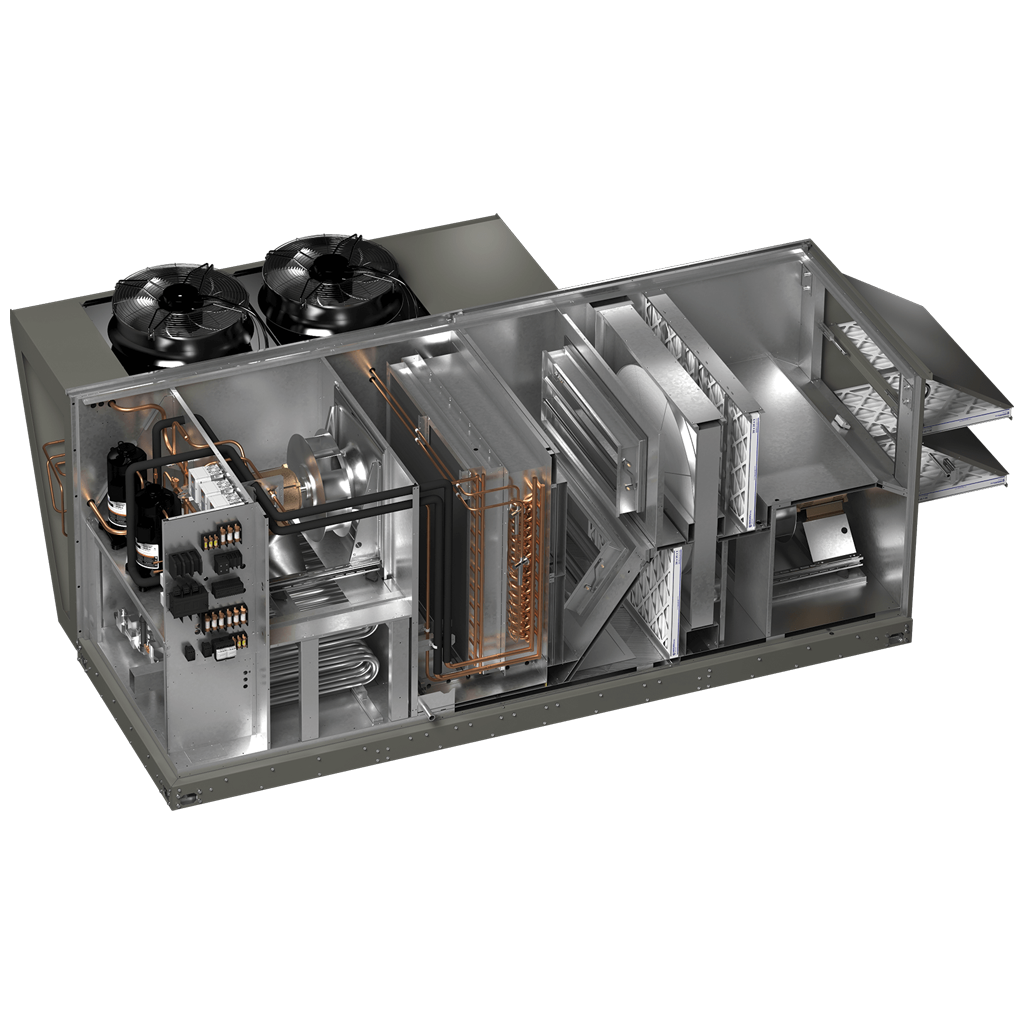

Replace Outdated Equipment

-

Fresh Air Ventilation

-

Preventative Maintenance & Repairs

Safer Air for a Safe School Environment

A budget-friendly way to provide clean air for in-person learning through the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Coronavirus Response and Relief Supplemental Appropriations (CRRSA) Act, and the American Rescue Plan (ARP) Act.

The pandemic relief funds can support immediate and longer-term projects to improve indoor air quality in school facilities.

How It Works

100% Tax Deductible Non-Structural Improvements

Any non-structural improvements made to an interior portion of a nonresidential building, including HVAC systems, are eligible for a 100% tax deduction with NO limitation on project cost. This money can be used to inspect, test, maintain, repair, replace, and upgrade HVAC systems.

Educational Facility Funding Benefits

Congress has approved pandemic relief bills allocating nearly $270 billion to support K-12 and Higher Education

Our Equipment Solutions

Protect Against COVID-19

Contact your TRS sales representative today to learn more about qualifying HVAC equipment upgrades.

Learn more about government funded programs:

K-12

Schools have until this September to obligate funds to specific purposes from the first round of federal COVID relief, ESSER I. The deadline to commit the second round of funds, ESSER II, is September 2023, and ESSER III is September 2024.

According to the AASA, “states and districts will be allowed to apply for an additional 18 months to liquidate all ESSER tranches of funding (including ARP) for school facility upgrades/HVAC work. In the context of ARP, this means that if the district signs the contract for these projects by September 2024, then the project would not need to be liquidated and the ARP funds entirely spent until April 2026.”

HIGHER EDUCATION/UNIVERSITIES

The Department of Education issued a notice in the Federal Register that the deadline for the HEERF performance period has been automatically extended to June 30, 2023. This applies to all open HEERF I, HEERF II, and HEERF III grants with a balance over $1,000.